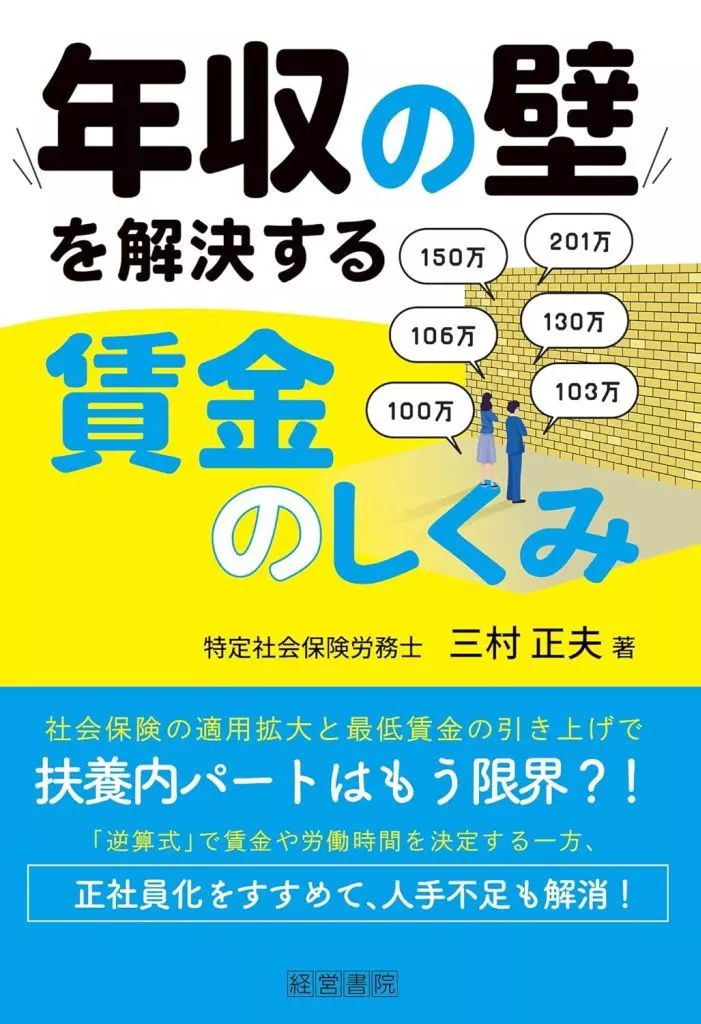

Book (Practical) Society Masao Mimura : A Mechanism the Annual Income Barrier

※Please note that product information is not in full comprehensive meaning because of the machine translation.

1,980JPY

2,346JPY

0JPY

Reference

Product description ※Please note that product information is not in full comprehensive meaning because of the machine translation.

Social

[Introduction to Contents]

There are many barriers to the annual income of being a Dependent Spouses, such as 1.03 million yen, 1.08 million yen, and 1.3 million yen, but the system is very complicated.

This book analyzes the "Annual Income Barrier" from the respective aspects of tax and social insurance, as well as the minimum wage by company size and area, and proposes a "Reverse Calculation System of Wages" that can be simply calculated for people who want to work as dependents.

However, the minimum wage will increase in the future, and the scope of work that can be continued as dependents will be further narrowed.

Therefore, I would like you to read about measures to make it possible for part-time employees who have been working as dependents to work as regular employees by using subsidies.

From October of this year, the application of social insurance will be expanded to companies with 51 to 100 employees.

What is the Annual Income Barrier?

Chapter 1 What is the Annual Income Barrier?

Chapter 2 Use of Subsidies for People with Annual Income Barrier

Chapter 3 Differences between Tax Laws and Social Insurance Barriers and br> Chapter 4 Use of Subsidies for People with Annual Income Barrier

Chapter 5 How to Develop People with Annual Income Barrier to Convert to Regular Employees

[Author brief history]

Born in Fukui City, Fukui.

After graduating from Shibaura Institute of Technology, joined Nippon Life Insurance.

Became independent in 2001 and served as the representative of Mimura licensed social insurance consultant Office, Mimura Management Labor Institute Co., Ltd.

Obtained 22 qualifications including licensed social insurance consultant and administrative scrivener.

He wrote many books including "Revised 3 Quick Work Rules for Small-Scale Companies" and "Simple Integrated Wage System for Small Companies" (both of which are Shokan Shoin).

Prologue : How to Think About the Annual Income Barrier "

Chapter 1 What is the Annual Income Barrier?

Chapter 4 Use of Subsidies for People with Annual Income Barrier"

Chapter 5 How to Develop People with Annual Income Barrier to Convert to Regular Employees "

Author brief history"

Born in Tokyo, Fukui.

Joined